Chipotle Mexican Grill, one of America's biggest casual dining chains, with around 3,885 restaurants, is rolling out new menu items designed to appeal to people using GLP-1a drugs for weight loss.

Unsurprisingly, the menu leans heavily to protein, a vital nutritional need of GLP-1 drug users, who experience a loss of 2kg of muscle mass for every 3kg of fat mass lost.

But Chipotle does not have to rely on only the 12% of Americans using GLP-1a to make the menu a success. Protein is now the top health interest of Americans; the menu items have wide appeal and the wider consumer market will still want to choose these products even if the GLP-1a frenzy fizzles.

The offering will resonate with a wide swathe of Chipotle's customers, who over-index on being health active and college-educated. Millennials aged 30-44 account for almost half of Chipotle's customer base. A particularly important group are those aged 25-35, accounting for 25% of sales. This age-group is one that is strongly into fitness and hence protein will hit the mark with them. It's also the age when many people start to find themselves having to work harder at weight management.

The High Protein Menu includes:

-

Double High Protein Bowl (81g protein, 11g fibre, 760 calories). This burrito bowl features Adobo Chicken, white rice, black beans, fajita vegetables, fresh tomato salsa, Monterey Jack cheese and romaine lettuce

-

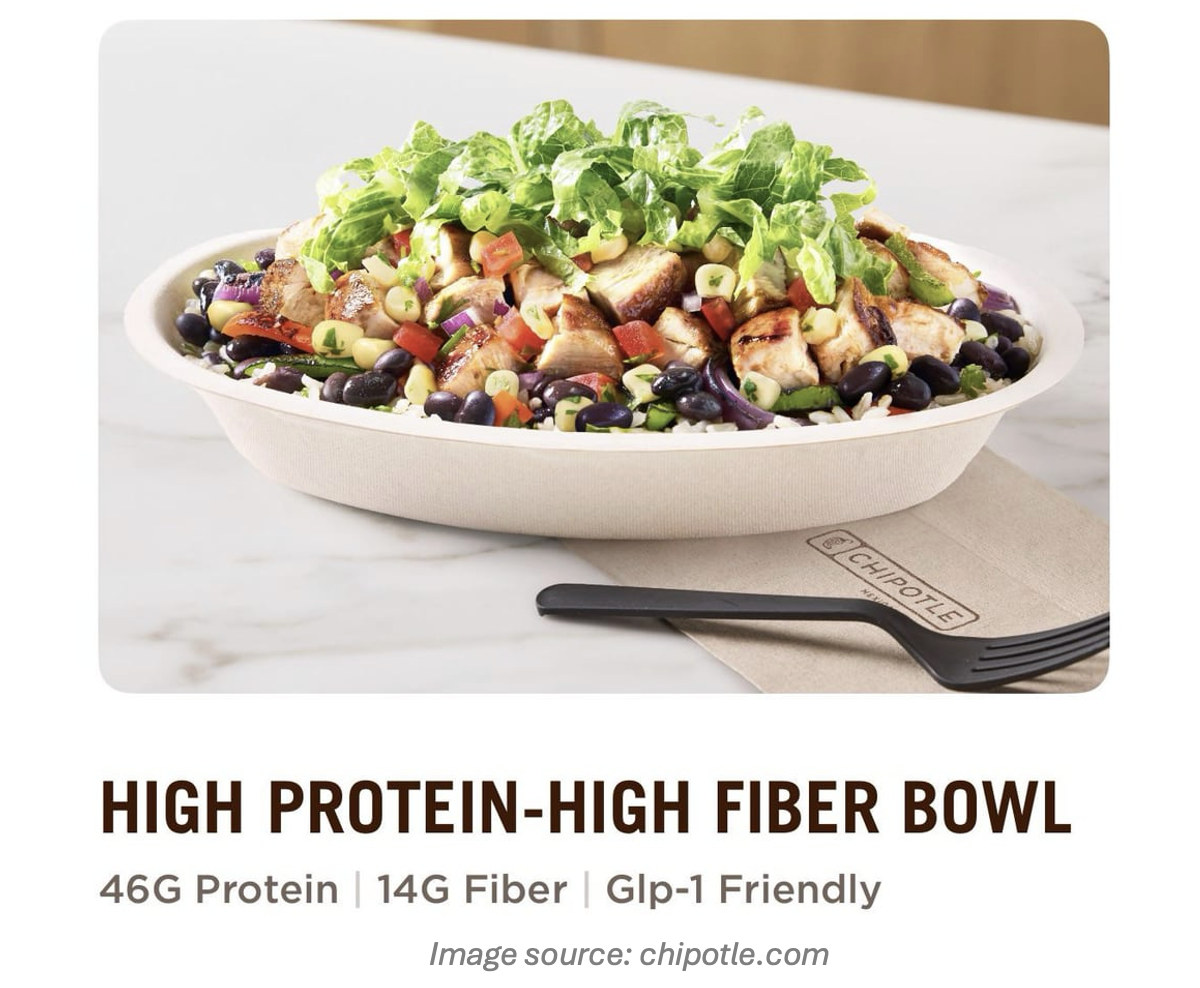

High Protein-High Fiber Bowl (46g protein, 14g fibre, 540 calories). Adobo Chicken, brown rice, black beans, fajita vegetables, roasted chili-corn salsa, tomato salsa and romaine lettuce

-

High Protein-Low Calorie Salad (36g protein, 10g fibre, 470 calories). Chicken, lettuce mix, fajita vegetables, tomato salsa and guacamole.

-

Double High Protein Burrito (79g protein, 6g fibre, 840 calories). Chicken, tomato salsa, fajita vegetables, Monterey Jack cheese and lettuce.

-

Adobo Chicken Taco (15g protein, 190 calories). A soft flour tortilla, chicken, fajita vegetables, tomato salsa, Monterey Jack cheese and lettuce.

The menu also includes what Chipotle has called its first "snack" - the High Protein Cup with Adobo Chicken (32g protein, 180 calories). That will appeal to GLP-1 users, who have smaller appetites thanks to the dramatic slowdown in their digestive system, but it's also a wise thing to do in an era in which many restaurant menus are commonly made up of "small plates" and tapas-style offers.

Chipotle's communications about the new menu flag up the GLP-1-friendly message, but the reality is that this is how a growing number of consumers who don't use weight-loss drugs actually want to eat. It also reflects existing consumer trends that have been developing for 15 years, long before GLP-1 came along. It's a launch which is low-risk for Chipotle.